24+ mortgage crisis of 2007

Web The Financial Crisis Inquiry Commission found that in 2008 GSE loans had a delinquency rate of 62 percent due to their traditional underwriting and qualification. The crisis can be attributed to several factors which emerged over a number of years.

Outlook For 2018 You Can Get What You Need Kkr

Web The global financial crisis of 2007-09 which began in the US market for subprime mortgage lending was a stark reminder of how housing systems can bring.

. Web In response to the subprime mortgage crisis the Mortgage Forgiveness Debt Relief Act of 2007 PL. Web Figure 2 charts the total volume of FHA and conventional small dollar loans those below 100000 from 2007 to 2021 in North Carolina. It was the most serious financial.

Web In 2009 the year when foreclosures peaked 28 million mortgage loans were in foreclosure almost four times the number in 2005. The Day the Mortgage Crisis Went Global A look at the problems exposed by the events that day and what investors bankers have learned since. The subprime mortgage crisis was one of the main contributors to the 2007-2009 global financial crisis.

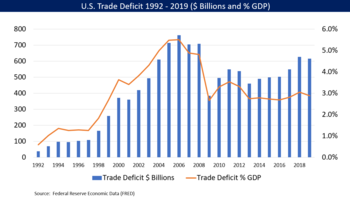

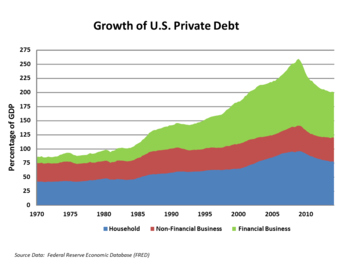

Web The downturn prompts a collapse of the US. Causes proposed include the inability of homeowners to make their mortgage payments due primarily to adjustable-rate mortgages resetting borrowers overextending predatory lending and speculation overbuilding during the boom period risky mortgage products increased power of mortgag. I t ranks among the most.

The collapse of the US. Web The 2007-09 economic crisis was deep and protracted enough to become known as the Great Recession and was followed by what was by some measures a. Web The Subprime Mortgage Crisis 2007-08 September 29 2021 American house prices rose by 124 percent between 1997 and 2006.

WASHINGTON Until the boom in subprime mortgages turned into a national nightmare this summer the few people who tried to warn federal banking. Web The 20072008 financial crisis or Global Financial Crisis GFC was a severe worldwide economic crisis that occurred in the early 21st century. Web Many homeowners in 2007 to 2009 found themselves underwater on their mortgages when real estate values fell and interest rates on mortgage payments rose.

Subprime mortgage industry which offered loans to individuals with poor credit sometimes without requiring a down payment. Web 1 hour agoThe Dallas Federal Reserve Bank a go-to source for mortgage and housing data added to worries this week with a new report warning of potential spillover risks of a. When the housing bubble burst many borrowers were.

Compared to FHA and. Also known as The Great. Web The subprime mortgage crisis occurred from 2007 to 2010 after the collapse of the US.

110-142 MRA was signed into law on December 20 2007.

The Subprime Mortgage Crisis Of 2007 2008 Youtube

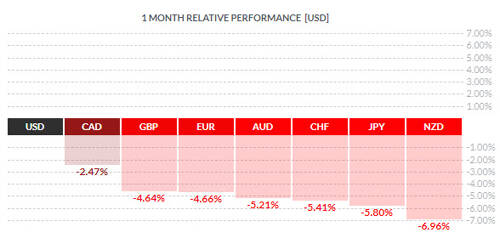

Is The Us Dollar The Global Safe Haven

Subprime Mortgage Crisis Wikipedia

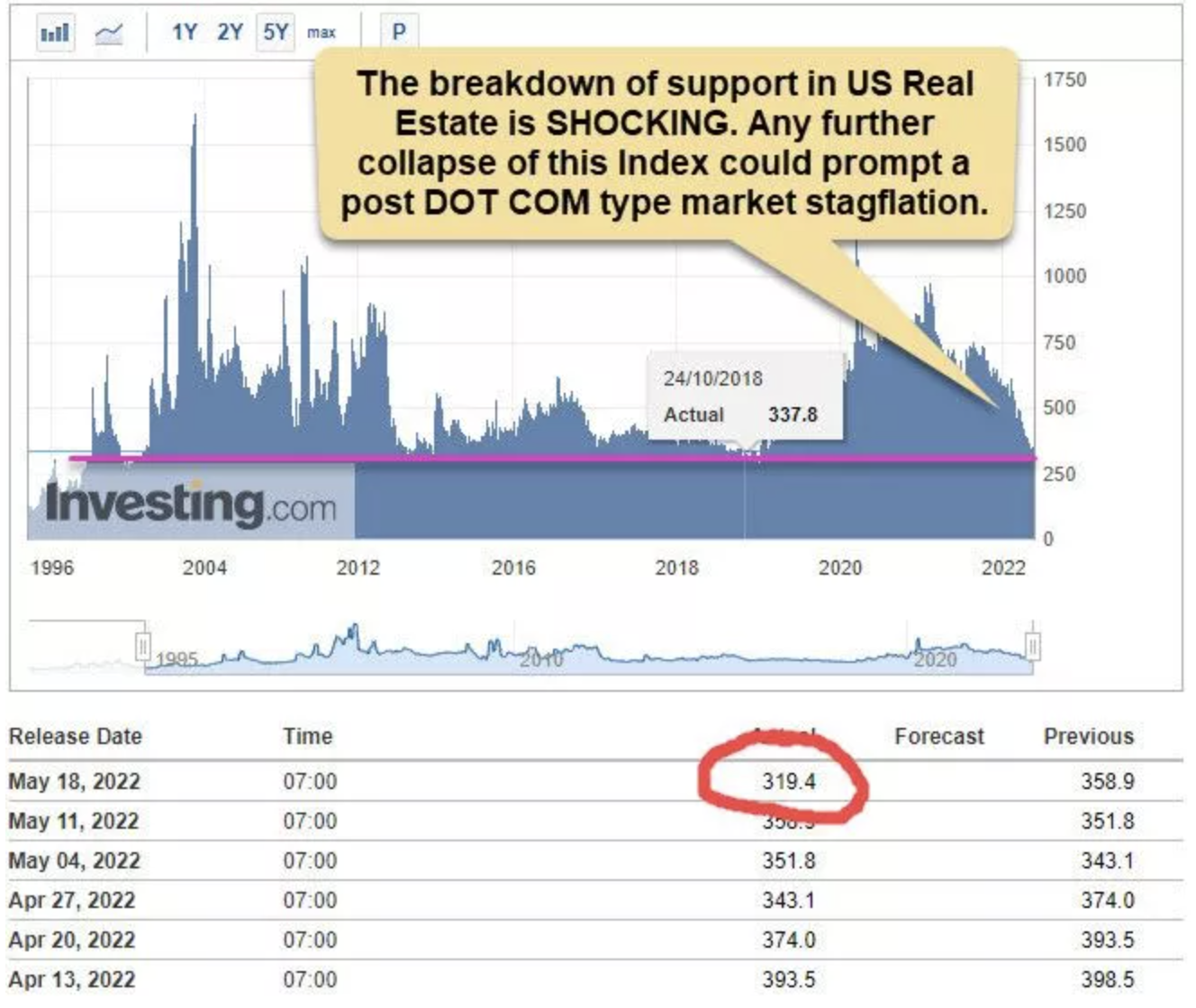

Consumer Pressure Is There An End In Sight Investing Com

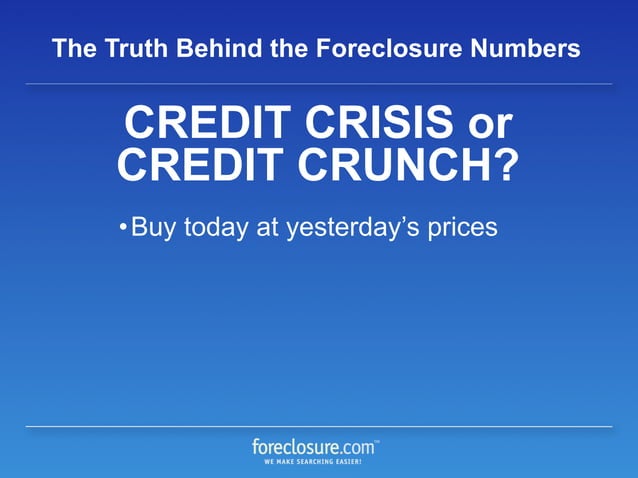

The Truth Behind The Foreclosure

Get Ready To Ride Your Home Value Down Because Real Estate Is Dead Part Iii

Subprime Mortgage Crisis Wikipedia

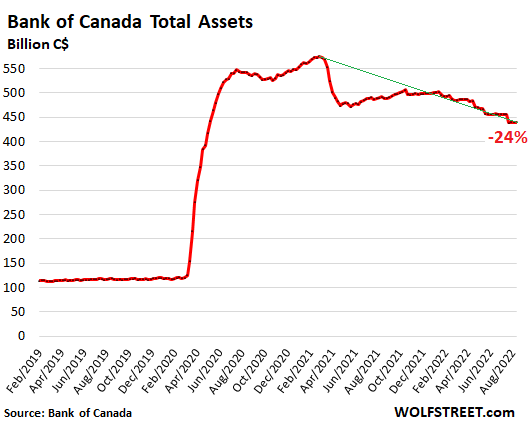

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

:max_bytes(150000):strip_icc()/Spencer_Platt_outside-56a9a6233df78cf772a936e3.jpg)

2007 Financial Crisis Explanation Causes Timeline

Subprime Mortgage Crisis Wikipedia

A Guide To The Financial Crisis 10 Years Later The Washington Post

The 2008 Mortgage Crisis During The Late 1990s And Early 2000s By Maggie Polk Medium

The Financial Crisis Of 2007 08 Trading History Avatrade

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/12742647/WallStreet_Graph_1.png)

The Financial Crisis Of 2008 How Housing Contributed Curbed

The 2008 Crash What Happened To All That Money History

2007 In Photos Mortgage Crisis

The 2008 Financial Crisis 5 Minute History Lesson Youtube