General investment account tax calculator

Some funds may require higher minimums. Brokerage account minimums start at 2500 but depend on the account type.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Contact a Fidelity Advisor.

. They offer diversification benefits because your money can be pooled into a much larger fund with other investors money. Youll have access to a range of different investment opportunities and can invest a regular monthly amount a lump sum or. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations.

The minimum for each subsequent investment is 50. The actual annual growth rate will depend on your investments and how they perform. So although theres no limit to.

You can earn up to 17570 a year in 2022-23 as long as your personal allowance is the standard 12570 and usually still be eligible for the starting rate for savings. Refer to the basic rate tax band The basic rate tax band is 32000 in the 201617-tax year 11000 43000. In one situation an investment account is not taxed until the money is withdrawn.

The calculator offers three alternative growth rates of 15 Lower 45 Intermediate and 75 Higher. A General Account doesnt have the same tax benefits as a Stocks and Shares ISA. This calculator shows an illustration of what your investments could be worth and not a projection of what your investments will be worth.

3 The CGT allowance is capped at 6150 for trusts. This means that up to 5000 of the interest received from savings is tax-free. Using the figures outlined above you add 18900 in gains to 19000 in taxable income to give you a total figure of 37900.

Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations. Risk is reduced by the wide spread of investments in the. If youve used your ISA allowance for the current tax year and have more to invest then this could be the account for you.

Well do the hard work choosing and building your portfolio and in a way that works for you. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Property Jewellery Vintage cars Cryptocurrency Stocks and shares And more.

Open an account With investment your capital is at risk. A General Investment Account allows you to access Collective Investment Schemes most commonly known as investment funds that bring the following benefits. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Capital Gains Tax is basically a tax that youre charged on money you make from selling an asset. GIA general investment account Stocks and shares ISA individual savings account SIPP self-invested personal pension You can have multiple different accounts open at the same time and each have unique benefits and deficits. For nearly two decades she worked as an investment portfolio manager and chief financial officer for a real estate holding company.

Any gains within this band are taxable at 10. Best Brokers for Low Fees. Capital gains taxes on most assets held for less than a year correspond to ordinary income tax rates.

Read more Important information Moneyfarm data The returns here are simulated using an assumed balance of 250000 and the average management fee from our pricing model of 046 from 01012016 to 31102017 and 055 from 01112017 to the 311219. The returns are net of underlying fund costs and market spread. Parametric is also registered as a portfolio manager with the securities regulatory authorities in certain provinces of Canada National Registration.

The tax rate on capital gains for most assets held for more than one year is 0 15 or 20. Guide to GIAs. The minimum to open a mutual fund account is 2500 per fund or 500 if you establish automatic investments of at least 100 a month.

Tools to help gauge potential growth the impacts of inflation and how you feel about risk. Find a Dedicated Financial Advisor Now. 2 The personal savings allowance for the 202122 tax year is 1000 for most basic rate taxpayers 500 for higher-rate taxpayers and zero for additional-rate taxpayers.

Any gains above this are taxed at 20. Best Ways to Invest 30K. Our general investment account is an easy flexible way of investing more of your money in the markets on top of your 20000 ISA allowance.

For more on dividend allowances see here. When we say asset this can mean any of the following. Do Your Investments Align with Your Goals.

Use our Capital Gains Tax calculator to work out what tax you owe on your investment profits. Investment advisory services offered through Parametric Portfolio Associates LLC Parametric an investment advisor registered with the US Securities and Exchange Commission CRD 114310. In the UK there are three main investment accounts are.

Best Online Brokers for Stocks. This investment growth calculator is intended to help compare a fully taxable investment to two tax advantaged situations. You can invest as much as you like theres no upper investment limit.

1 The UK tax year runs from 6 April to 5 April each year. Estimate how an investment may grow learn how you feel about risk or figure out the potential impacts of inflation with these calculators. A general investment account GIA is a medium to long-term investment that could be an option if youve used up your ISA allowance and dont want to lock your money away in a pension.

What is a General Account. Barbara Friedberg is an author teacher and expert in personal finance specifically investing. In the second scenario the money is an investment that is not subject to Federal or State tax.

Calculating The Gross Margin Ratio For A Business For Dummies Gross Margin Income Statement Profit And Loss Statement

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

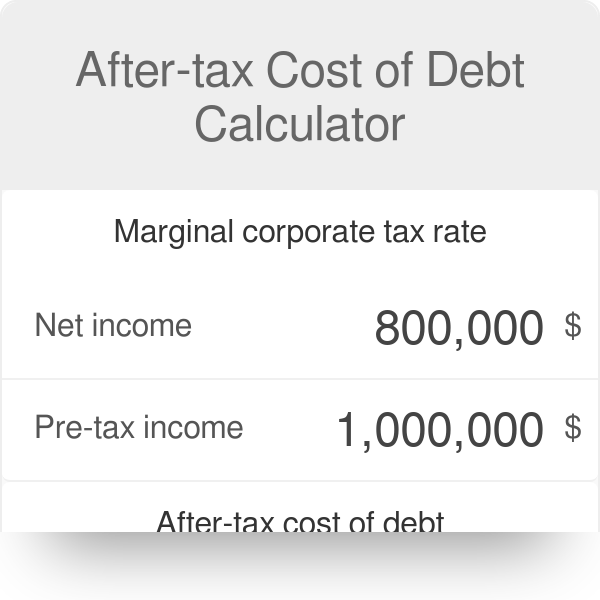

After Tax Cost Of Debt Calculator Required Return Of Debt

Iqexxkzshldbom

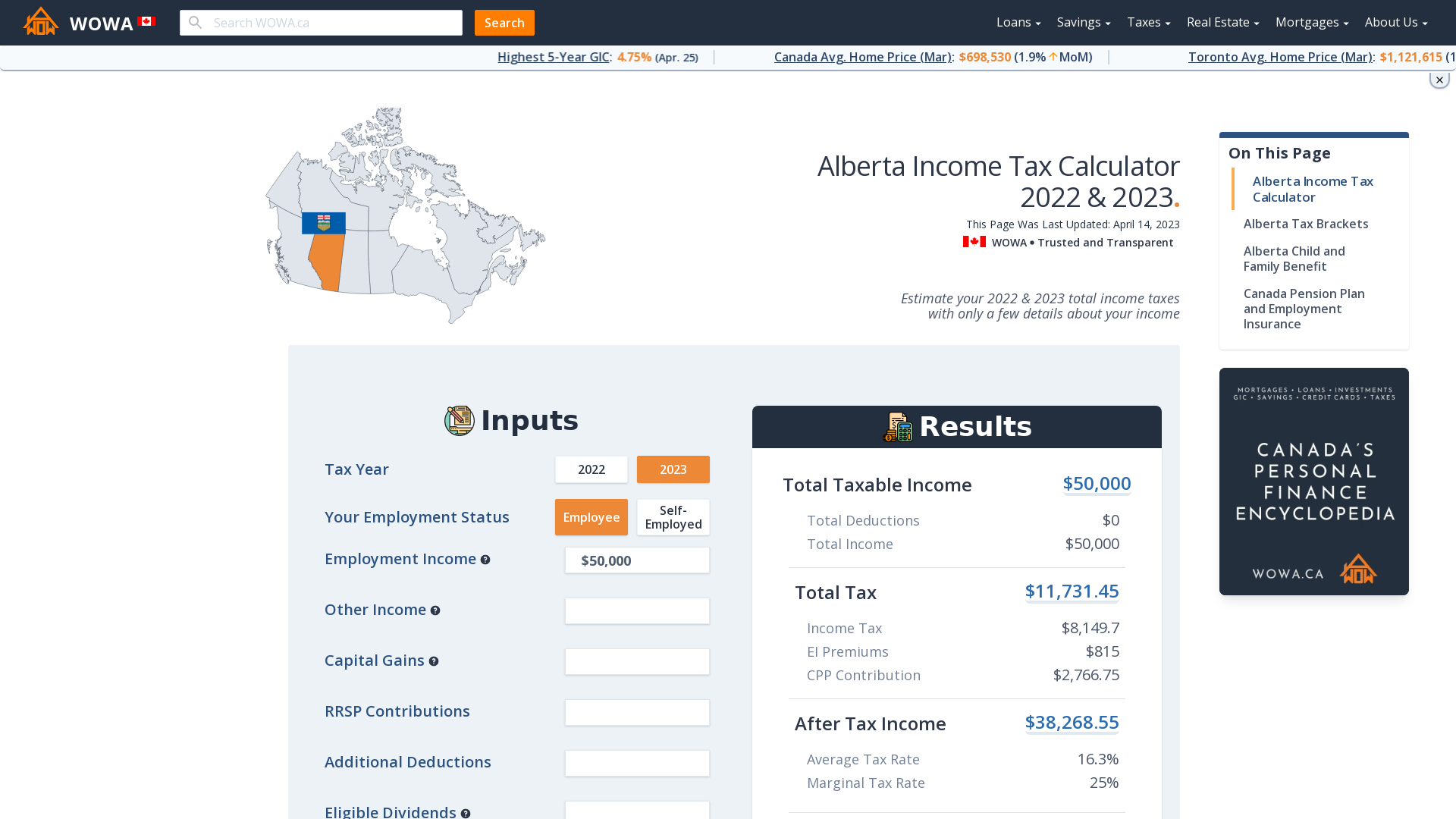

Alberta Income Tax Calculator Wowa Ca

Tax Free Savings Account Tfsa My Road To Wealth And Freedom Tax Free Savings Savings Account Small Business Tax Deductions

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Tax Calculator Estimate Your Income Tax For 2022 Free

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Net Profit Margin Calculator Bdc Ca

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro Income Tax Interest Calculator Credit Card Interest

It S Essential That You Organize Yourself When It Comes To Paying Tax It Seems Like A Drag On Profits Or A Waste Of Income Tax Return Income Tax Business Tax

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Sales Tax Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Income Tax